Experts Agree: Options are Improving for Buyers

Buyers hoping for more homes to choose from may be in luck as housing inventory begins to rise. Many experts agree – new sellers listing their homes is great news for buyers and the overall market.

Housing Supply is Rising. What Does That Mean for You?

An important factor in today’s market is the number of homes for sale. While inventory levels continue to sit near historic lows, there are indications we may have hit the lowest point we’ll see.

Why This Isn’t Your Typical Summer Housing Market

In real estate, it’s normal to see ebbs and flows in the market. Typically, the summer months are slower-paced than the traditionally busy spring. But this isn’t a typical summer. As the economy rebounds and life is returning to normal, the real estate market is expected to have an unusually strong summer season.

Selling Your House? Make Sure You Price It Right.

There’s no denying we’re in a sellers’ market. With low inventory and high buyer demand, homes today are selling above the asking price at a record rate. Because so many buyers are competing for so few homes, bidding wars are driving up home prices. While it may be tempting to price your house on the high side to capitalize on this trend, doing so could limit your house’s potential.

The Truths Young Homebuyers Need to Hear

For many young or first-time homebuyers, purchasing a home can feel intimidating. A recent survey shows some homebuyers ages 25 to 40 may be unsure about the homebuying process and what they can afford.

Home Builders Ramp Up Construction Based on Demand

If you’re thinking of buying a home, there really is no time like the present. With today’s low mortgage rates, you have a great opportunity to get more home for your money. The challenge is inventory. Like you, many buyers want to capitalize on these market conditions, and it’s leading to more buyer competition and bidding wars.

Are We in a Housing Bubble? Experts Say No.

The question of whether the real estate market is a bubble ready to pop seems to be dominating a lot of conversations – and everyone has an opinion. Yet, when it comes down to it, the opinions that carry the most weight are the ones based on experience and expertise.

What Do Experts See on the Horizon for the Second Half of the Year?

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon?

What to Expect as Appraisal Gaps Grow

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm.

Homebuyers: Hang in There

Today’s sellers’ market provides unique challenges—and benefits—for buyers. Current low interest rates won’t last forever, and home prices are forecast to rise. If you’re a homebuyer, hang in there. Homeownership improves your quality of life, and the long-term benefits outweigh the short-term challenges.

Demand for Vacation Homes is Still Strong

The pandemic created a tremendous interest in vacation homes across the country. Throughout the last year, many people purchased second homes as a safe getaway from the challenges of the health crisis. With many professionals working from home and many students taking classes remotely, it made sense to see a migration away from cities and into counties with more vacation destinations.

Homeowner Wealth Increases Through Growing Equity This Year

Building financial wealth and stability remains one of the top reasons Americans choose to own a home, and as a homeowner, your wealth often grows without you even realizing it. In a recent paper published by the Urban Institute, Home Ownership is Affordable Housing, author Mike Loftin illustrates how homeowners increase their equity and their wealth simply by making monthly mortgage payments

Pre-Approval Makes All the Difference When Buying a Home

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a clear understanding of your budget so you stand out to sellers as a serious homebuyer.

5 Things Homebuyers Need to Know When Making an Offer

When it comes to buying a house, you’re looking for the perfect place to call home. The problem is, in today’s market there just aren’t that many homes available to purchase. With inventory hovering near record lows and sky-high buyer demand, a multi-offer scenario is the new normal. Here are five things to keep in mind when you’re ready to make an offer

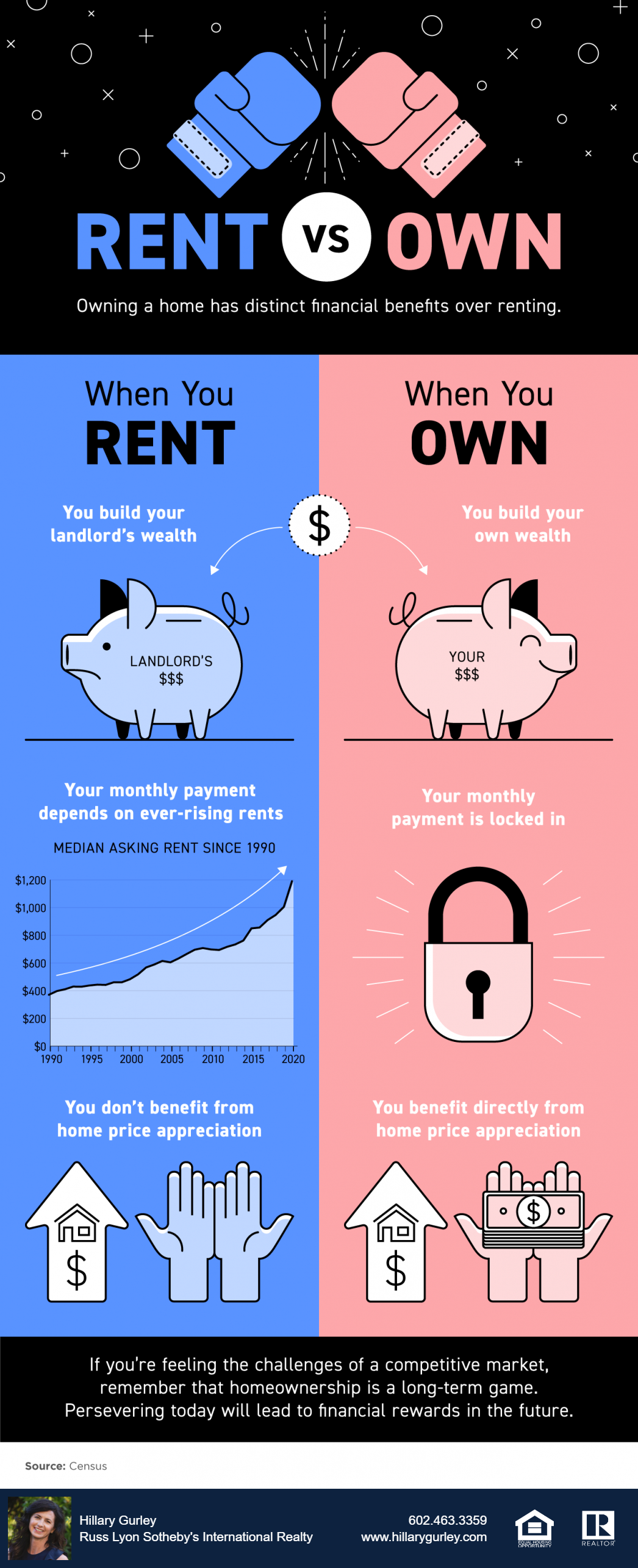

Owning a Home Has Distinct Financial Benefits Over Renting

When you rent, you build your landlord’s wealth, your monthly payment depends on ever-rising rents, and you don’t benefit from home price appreciation. On the other hand, when you own your home, you build your own wealth, your monthly payment is locked in, and you benefit directly from home price appreciation.

Housing Wealth: The Missing Piece of the Affordability Equation

The real estate market is soaring today. Residential home values are rising, and that’s a big win for homeowners. In 2020, there was a double-digit increase in home values – a trend that’s expected to head toward similar levels this year. However, skyrocketing prices are causing some to start questioning affordability in the current housing market. Many are quick to emphasize the fact that homes today are less affordable than they were last year. Black Knight, a leading provider of data and analytics across the homeownership life cycle, just reported on the issue.

Hope Is On the Horizon for Today’s Housing Shortage

The major challenge in today’s housing market is that there are more buyers looking to purchase than there are homes available to buy. Simply put, supply can’t keep up with demand. A normal market has a 6-month supply of homes for sale. Anything over that indicates it’s a buyers’ market, but an inventory level below that threshold means we’re in a sellers’ market. Today’s inventory level sits far below the norm.

The Right Expert Will Guide You Through This Unprecedented Market

In a normal market, it’s good to have an experienced guide coaching you through the process of buying or selling a home. That person can advise you on important things like pricing your home correctly or the first steps to take when you’re ready to buy. However, the market we’re in today is far from normal. As a result, an expert isn’t just good to have by your side – an expert is essential.

Have Your Day in the Sun by Moving Up This Summer

Longer days and sunny weather mean summer is upon us, and what better conditions than right now to upgrade to the home of your dreams?

Home Price Appreciation is as Simple as Supply and Demand

Home price appreciation continues to accelerate. Today, prices are driven by the simple concept of supply and demand. Pricing of any item is determined by how many items are available compared to how many people want to buy that item. As a result, the strong year-over-year home price appreciation is simple to explain. The demand for housing is up while the supply of homes for sale hovers at historic lows.