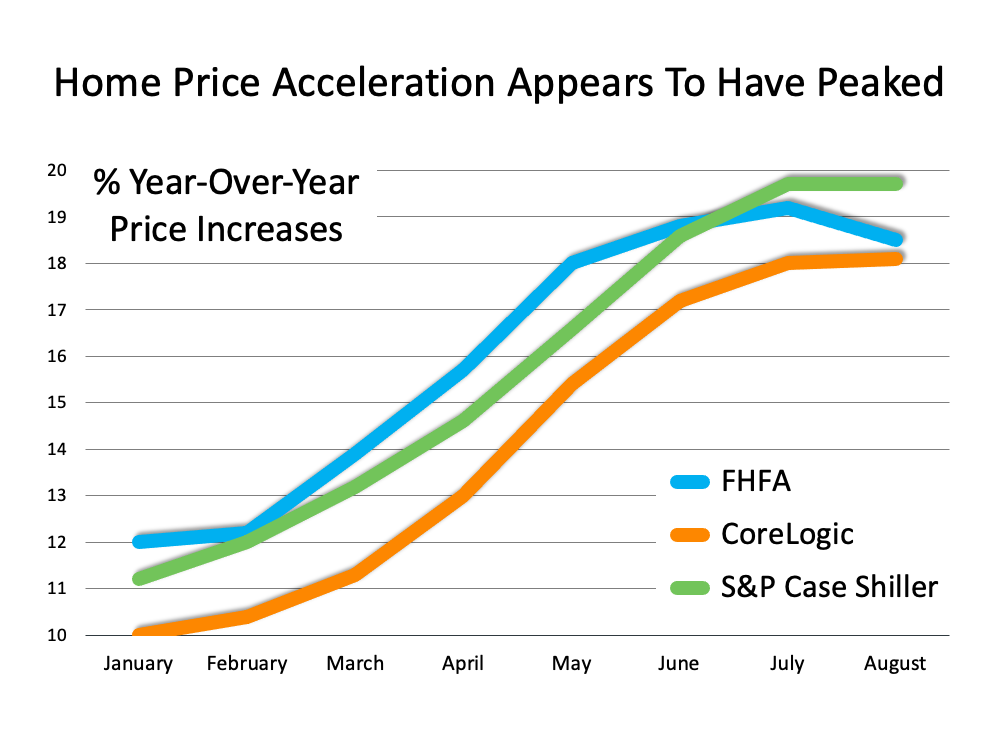

What’s Happening with Home Prices?

Many people have questions about home prices right now. How much have prices risen over the past 12 months? What’s happening with home values right now? What’s projected for next year? Here’s a look at the answers to all three of these questions.

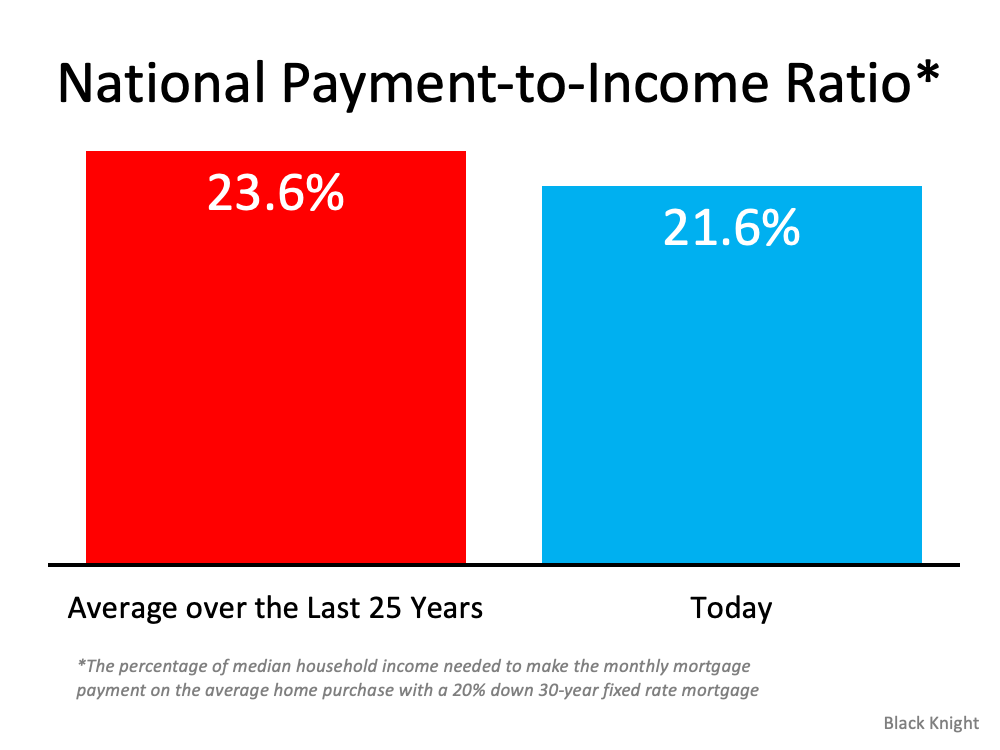

Important Distinction: Homes Are Less Affordable, Not Unaffordable

It’s true that it’s less affordable to buy a home today than it has been the last few years. However, it’s more affordable to buy today than the average over the last 25 years. In other words, homes are less affordable, but they’re not unaffordable. That’s an important distinction.

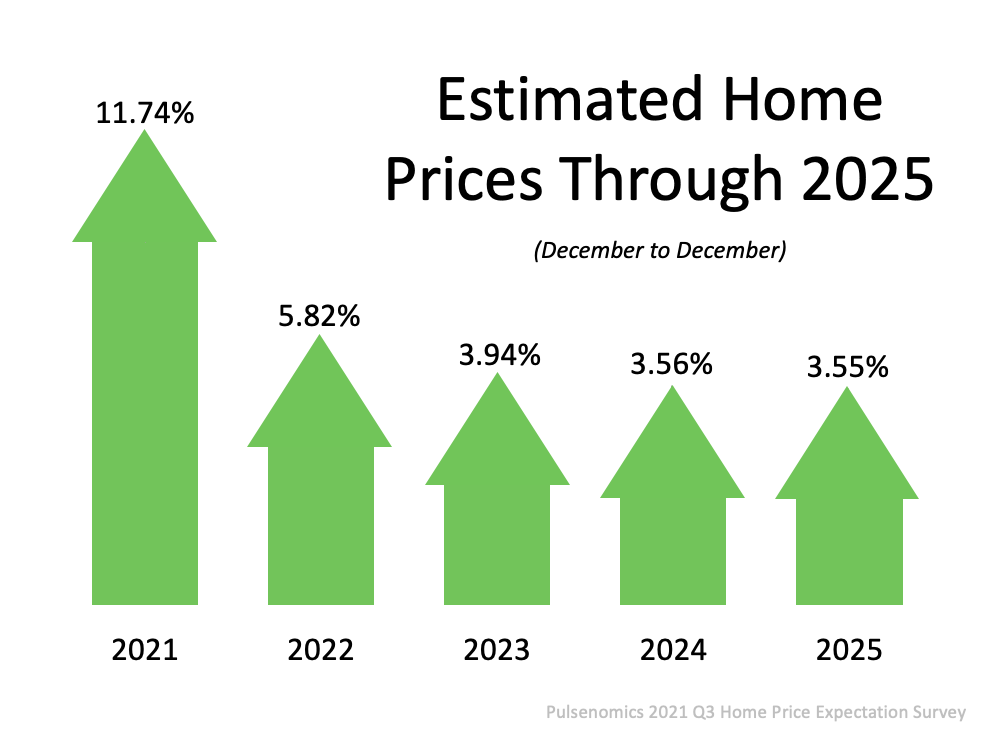

What Does the Future Hold for Home Prices?

If you’re looking to buy or sell a house, chances are you’ve heard talk about today’s rising home prices. It’s important to note home prices have increased, or appreciated, for 114 straight months. To find out if that trend may continue, look to the experts.

Early October is the Sweet Spot for Buyers

While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today? As a buyer, you’re likely braving bidding wars and weighing low mortgage rates versus price appreciation as you search for your dream home. If you find yourself a bit discouraged, hear this: there are clear signs buyers may have more opportunities this fall.

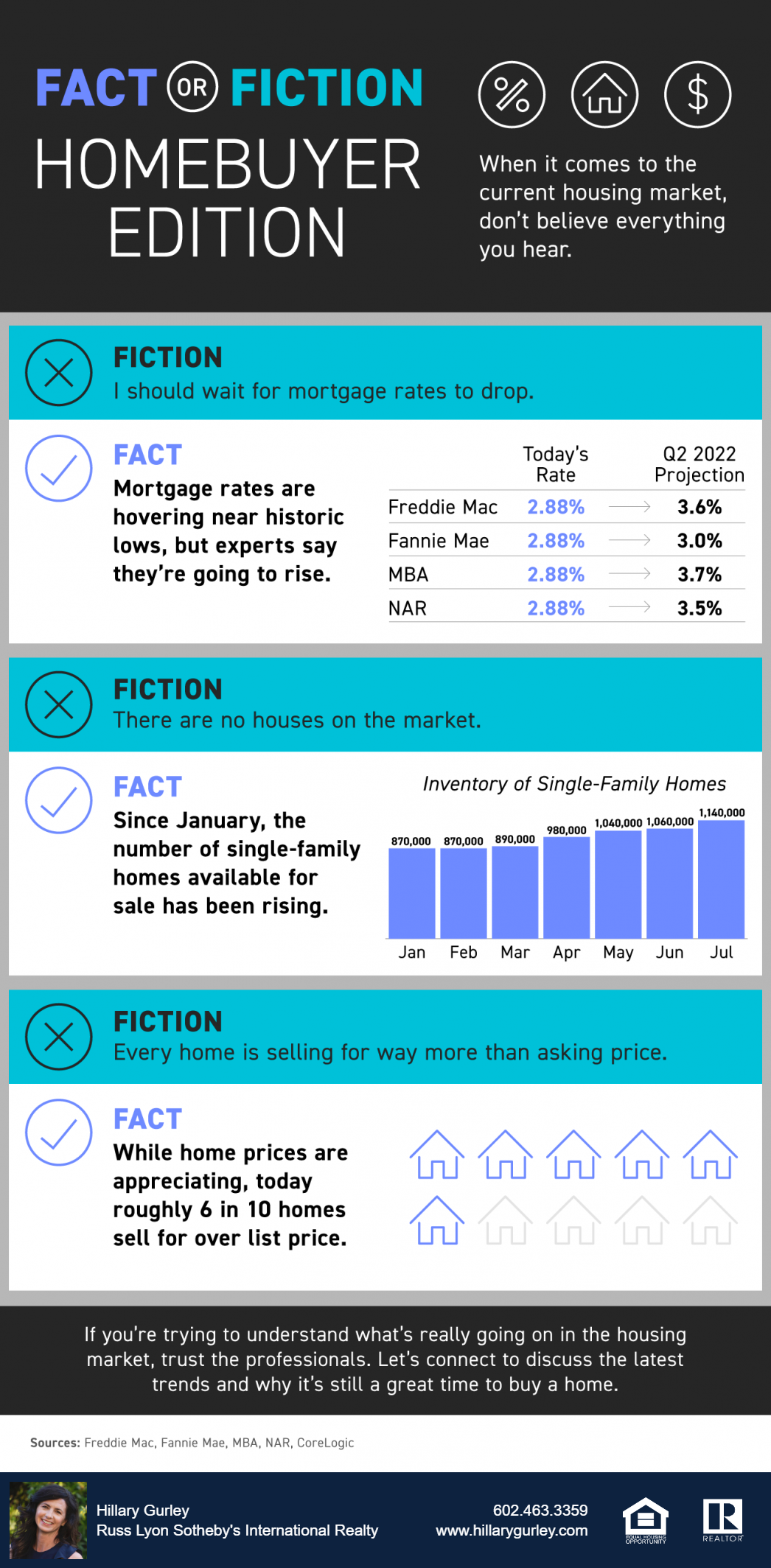

If You’re a Buyer, Is Offering Asking Price Enough?

Homes selling quickly and receiving multiple offers highlights how competitive the housing market is right now. This is due, in large part, to the low supply of homes for sale. Low supply and high demand mean homes often sell for more than the asking price. In some cases, they sell for a lot more. Selma Hepp, Deputy Chief Economist at CoreLogic, explains how these stats can impact buyers:

Fact or Fiction: Homebuyer Edition

When it comes to the current housing market, there are multiple misconceptions – from what the current supply of available homes looks like to how much houses are selling for. It takes professionals who study expert opinions and data to truly understand the real estate market and separate fact from fiction. Trust the pros.

Home Price Appreciation is Skyrocketing in 2021. What About 2022?

One of the major story lines over the last year is how well the residential real estate market performed. One key metric in the spotlight is home price appreciation. According to the latest indices, home prices are skyrocketing this year.

The Difference in Net Worth Between Homeowners and Renters is Widening

Becoming financially secure is an important goal for many people today, but some don’t realize just how much homeownership can help them achieve that dream. A recent report, The Journey Toward Financial Freedom, surveys Americans about their perspective on financial wellness and their goals

A Look at Home Price Appreciation and What It Means for Sellers

When you hear the phrase home price appreciation, what does it mean to you? Through context clues alone, chances are you know it has to do with rising home prices. And as a seller, you know rising home prices are good news for your potential sale. But let’s look past the dollar signs and dive deeper into the concept. To truly understand home price appreciation, you need to know how it works and why it matters to you.

Are Houses Less Affordable Than They Were in Past Decades?

There are many headlines about how housing affordability is declining. The headlines are correct: it’s less affordable to purchase a home today than it was a year ago. However, it’s important to give this trend context. Is it less expensive to buy a house today than it was in 2005? What about 1995? What happens if we go all the way back to 1985? Or even 1975?

Sellers: Make Today’s Home Price Appreciation Work for You

Home prices continue to rise as we move through the summer, and that’s good news for sellers who are looking to maximize their home’s potential. If you’re on the fence about whether to list your house now or later, the question you should really ask is: will this price appreciation last?

With Rents on the Rise - Is Now the Time To Buy?

According to recent data from realtor.com, median rental prices have reached their highest point ever recorded in many areas across the country. The report found rents rose by 8.1% from the same time last year. If you’re a renter concerned about rising prices, now may be the time to consider purchasing a home.

Key Questions to Ask Yourself Before Buying a Home

Sometimes it can feel like everyone has advice when it comes to buying a home. While your friends and loved ones may have your best interests in mind, they may also be missing crucial information about today’s housing market that you need to make your best decision.

A Look at Home Price Appreciation Through 2025

Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s equity. And with these recent gains, homeowners are witnessing their financial stability and well-being grow to record levels.

Are We in a Housing Bubble? Experts Say No.

The question of whether the real estate market is a bubble ready to pop seems to be dominating a lot of conversations – and everyone has an opinion. Yet, when it comes down to it, the opinions that carry the most weight are the ones based on experience and expertise.

How Much Time Do You Need to Save For a Down Payment?

One of the biggest hurdles homebuyers face is saving for a down payment. As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there. The process may actually move faster than you think.

Latest Jobs Report: What Does It Mean for You & the Housing Market?

Last Friday, the Bureau of Labor Statistics released a very encouraging jobs report. The economy gained 916,000 jobs in March – well above expert projections of 650,000 to 675,000. The unemployment rate fell again and is now at 6%.

Our lives are deeply impacted by our nation’s economy. The better the economy is doing overall, the better most individuals in the country will do as well. Here’s a look at what four experts told the Wall Street Journal after reviewing last week’s report.

Why You Should Think About Listing Prices Like an Auction’s Reserve Price

For generations, the homebuying process never really changed. The seller would try to estimate the market value of the home and tack on a little extra to give themselves some negotiating room. That figure would become the listing price of the house. Buyers would then try to determine how much less than the full price they could offer and still get the home. The asking price was generally the ceiling of the negotiation. The actual sales price would almost always be somewhat lower than the list price. It was unthinkable to pay more than what the seller was asking. Today is different.

6 Simple Graphs Proving This is Nothing Like Last Time

Many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year before. 2020 was so strong that many now fear the market’s exuberance mirrors that of the last housing boom and, as a result, we’re now headed for another crash. However, there are many reasons this real estate market is nothing like 2008. Here are six visuals to show the dramatic differences.

How Smart is it to Buy a Home Today?

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move. However, there’s one category that provides a simple answer. When deciding to buy now or wait until next year, the financial aspect of the purchase is easy to evaluate.