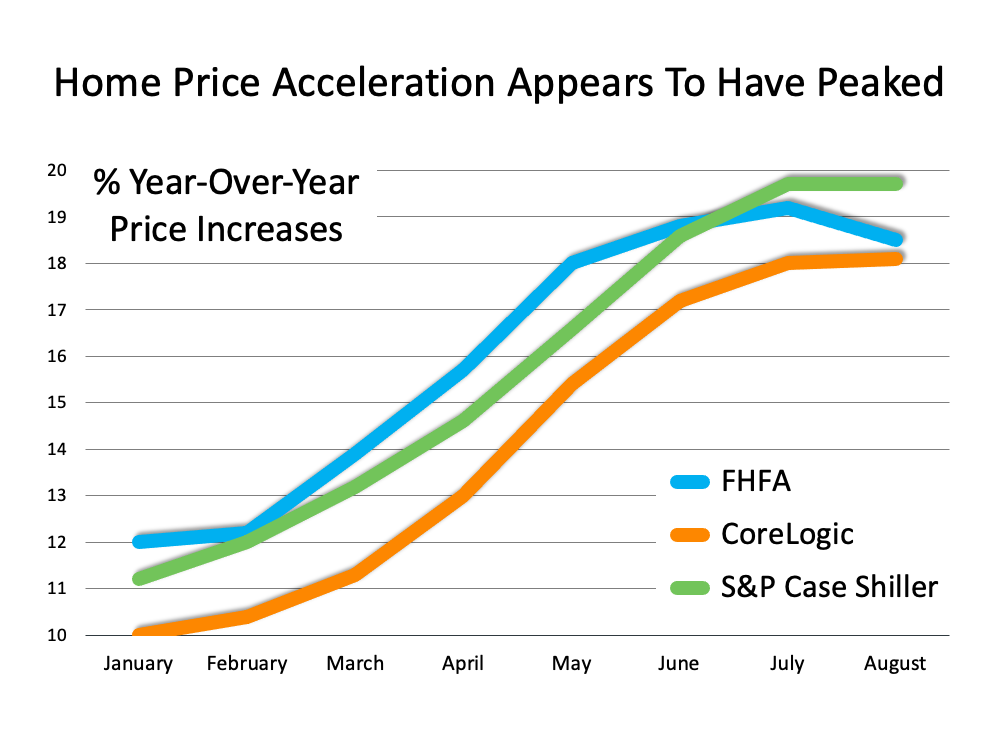

What’s Happening with Home Prices?

Many people have questions about home prices right now. How much have prices risen over the past 12 months? What’s happening with home values right now? What’s projected for next year? Here’s a look at the answers to all three of these questions.

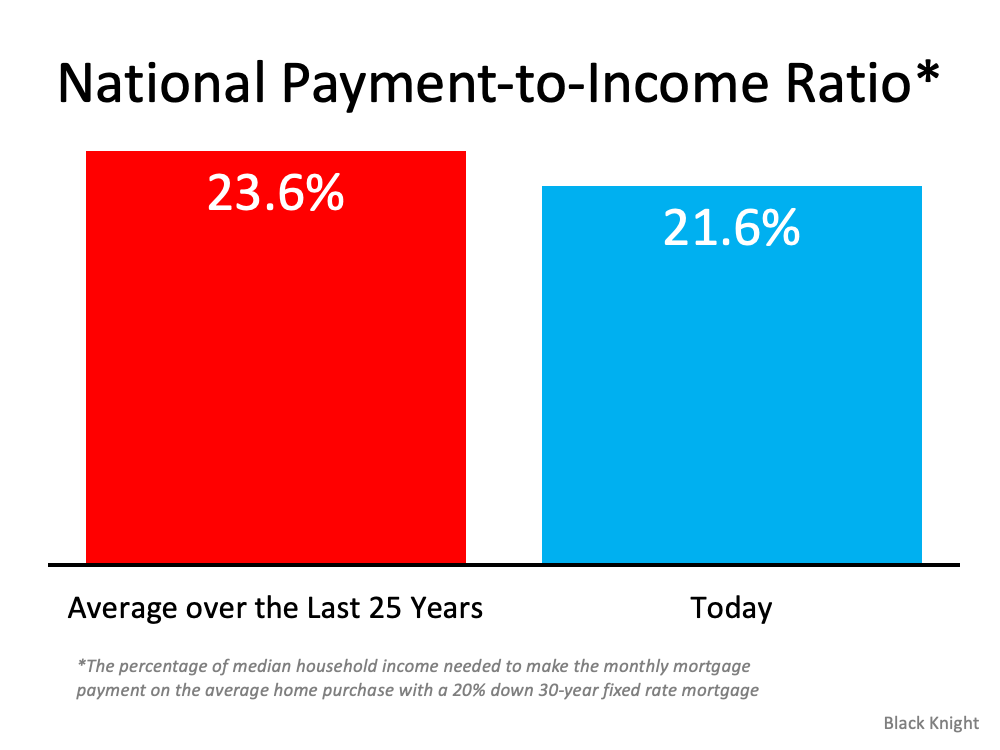

Important Distinction: Homes Are Less Affordable, Not Unaffordable

It’s true that it’s less affordable to buy a home today than it has been the last few years. However, it’s more affordable to buy today than the average over the last 25 years. In other words, homes are less affordable, but they’re not unaffordable. That’s an important distinction.

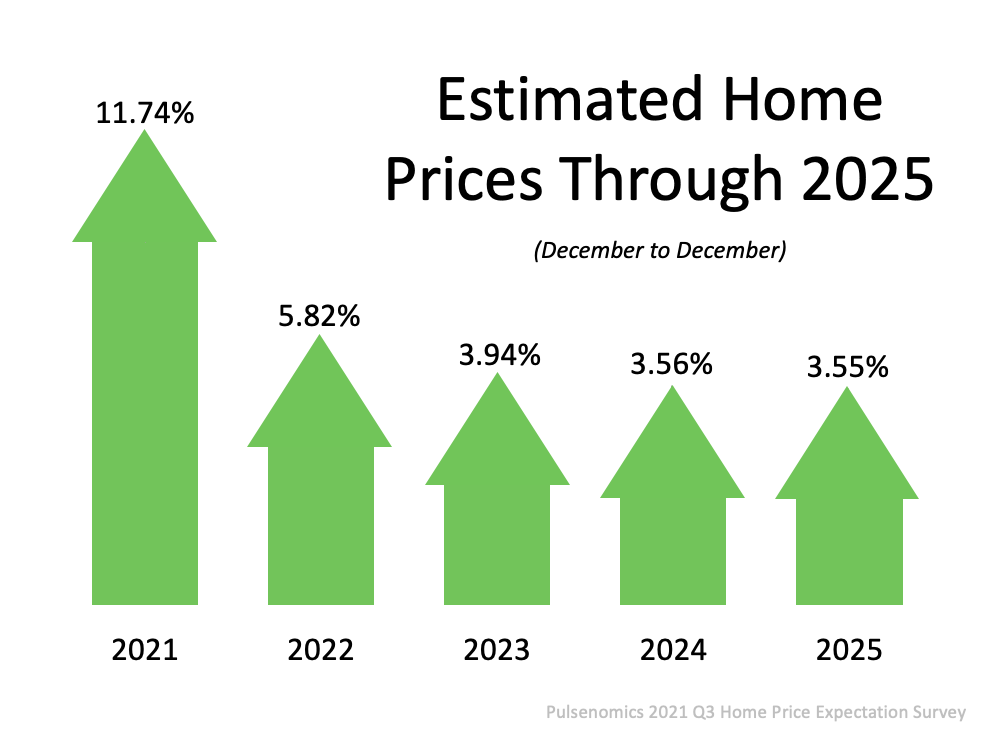

What Does the Future Hold for Home Prices?

If you’re looking to buy or sell a house, chances are you’ve heard talk about today’s rising home prices. It’s important to note home prices have increased, or appreciated, for 114 straight months. To find out if that trend may continue, look to the experts.

Early October is the Sweet Spot for Buyers

While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today? As a buyer, you’re likely braving bidding wars and weighing low mortgage rates versus price appreciation as you search for your dream home. If you find yourself a bit discouraged, hear this: there are clear signs buyers may have more opportunities this fall.

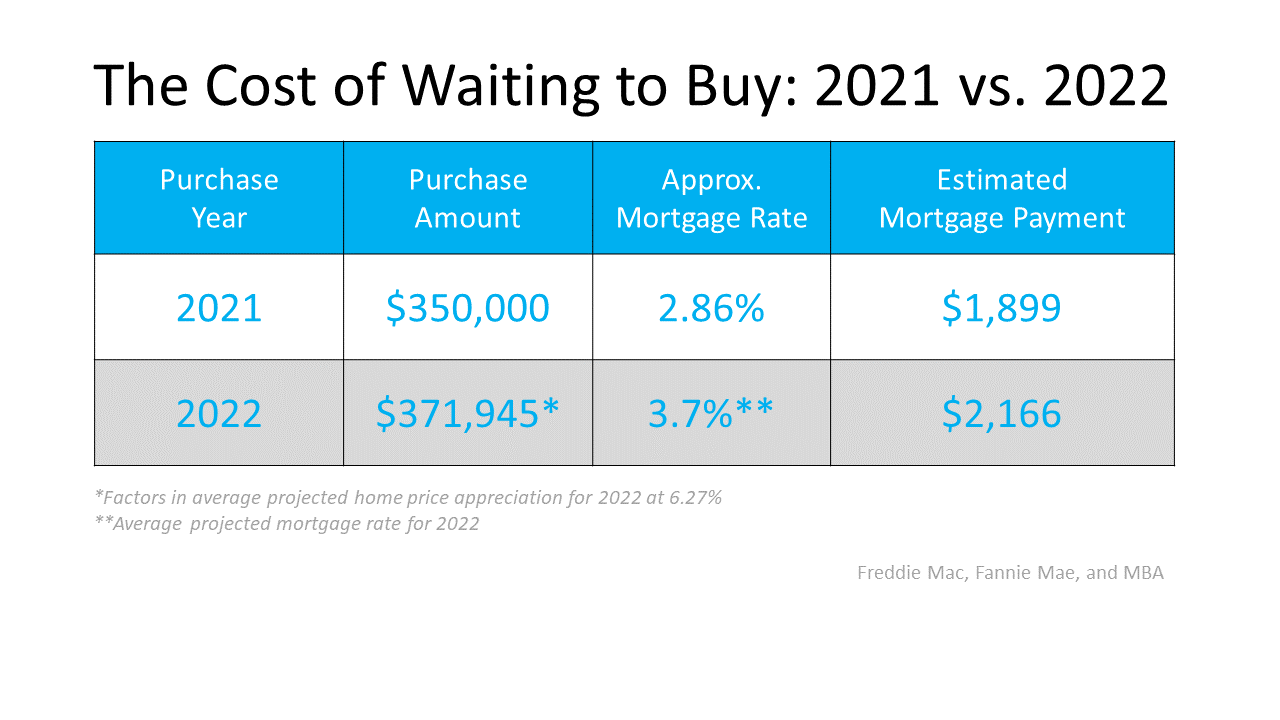

Two Reasons Why Waiting a Year To Buy Could Cost You

If you’re a renter with a desire to become a homeowner, or a homeowner who’s decided your current house no longer fits your needs, you may be hoping that waiting a year might mean better market conditions to purchase a home.

To determine if you should buy now or wait, you need to ask yourself two simple questions:

What will home prices be like in 2022?

Where will mortgage rates be by the end of 2022?

Let’s shed some light on the answers to both of these questions.

Your Agent is Key When Pricing Your House

Pricing your house right takes market experience and expertise. To find the best list price, your agent balances current market demand, values of homes in your neighborhood, where prices are headed, and your home’s condition.

If Housing Affordability is About the Money, Don’t Forget This.

There are many non-financial benefits of buying your own home. However, today’s headlines seem to be focusing primarily on the financial aspects of homeownership – specifically affordability. Many articles are making the claim that it’s not affordable to buy a home in today’s market, but that isn’t the case.

What Does Being in a Sellers’ Market Mean?

Whether or not you’ve been following the real estate industry lately, there’s a good chance you’ve heard we’re in a serious sellers’ market. But what does that really mean? And why are conditions today so good for people who want to list their house?

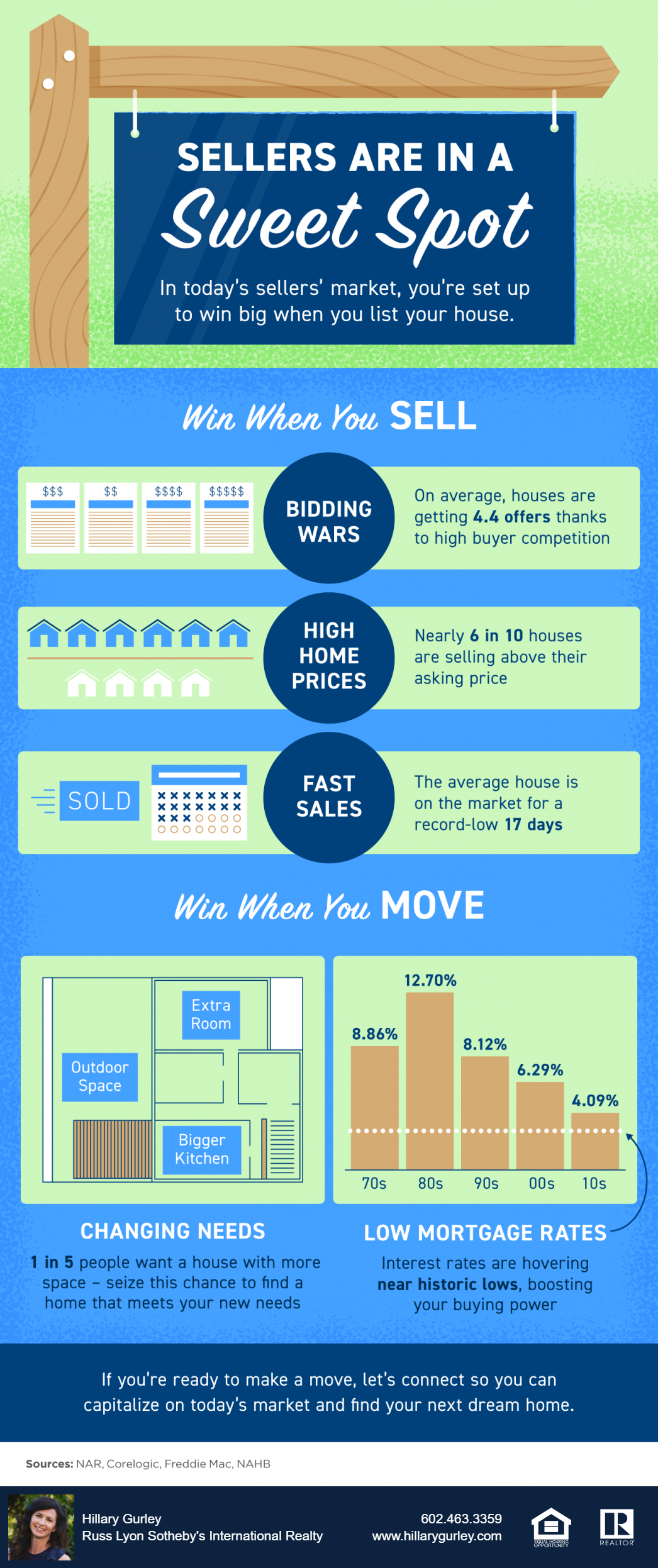

Sellers Are in a Sweet Spot

In today’s sellers’ market, you’re set up to win big when you list your house.

Are Houses Less Affordable Than They Were in Past Decades?

There are many headlines about how housing affordability is declining. The headlines are correct: it’s less affordable to purchase a home today than it was a year ago. However, it’s important to give this trend context. Is it less expensive to buy a house today than it was in 2005? What about 1995? What happens if we go all the way back to 1985? Or even 1975?

The Community and Economic Impact of A Home Sale

If you’re thinking of buying or selling a house, chances are you’re focusing on the many extraordinary ways it’ll change your life. What you may not realize is that decision impacts people’s lives far beyond your own. Home purchases and sales are significant drivers of economic activity.

What You Should Do Before Interest Rates Rise

In today’s real estate market, mortgage interest rates are near record lows. If you’ve been in your current home for several years and haven’t refinanced lately, there’s a good chance you have a mortgage with an interest rate higher than today’s average. Here are some options you should consider if you want to take advantage of today’s current low rates before they rise.

Experts Agree: Options are Improving for Buyers

Buyers hoping for more homes to choose from may be in luck as housing inventory begins to rise. Many experts agree – new sellers listing their homes is great news for buyers and the overall market.

Housing Supply is Rising. What Does That Mean for You?

An important factor in today’s market is the number of homes for sale. While inventory levels continue to sit near historic lows, there are indications we may have hit the lowest point we’ll see.

Selling Your House? Make Sure You Price It Right.

There’s no denying we’re in a sellers’ market. With low inventory and high buyer demand, homes today are selling above the asking price at a record rate. Because so many buyers are competing for so few homes, bidding wars are driving up home prices. While it may be tempting to price your house on the high side to capitalize on this trend, doing so could limit your house’s potential.

What Do Experts See on the Horizon for the Second Half of the Year?

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon?

5 Things Homebuyers Need to Know When Making an Offer

When it comes to buying a house, you’re looking for the perfect place to call home. The problem is, in today’s market there just aren’t that many homes available to purchase. With inventory hovering near record lows and sky-high buyer demand, a multi-offer scenario is the new normal. Here are five things to keep in mind when you’re ready to make an offer

Housing Wealth: The Missing Piece of the Affordability Equation

The real estate market is soaring today. Residential home values are rising, and that’s a big win for homeowners. In 2020, there was a double-digit increase in home values – a trend that’s expected to head toward similar levels this year. However, skyrocketing prices are causing some to start questioning affordability in the current housing market. Many are quick to emphasize the fact that homes today are less affordable than they were last year. Black Knight, a leading provider of data and analytics across the homeownership life cycle, just reported on the issue.

Hope Is On the Horizon for Today’s Housing Shortage

The major challenge in today’s housing market is that there are more buyers looking to purchase than there are homes available to buy. Simply put, supply can’t keep up with demand. A normal market has a 6-month supply of homes for sale. Anything over that indicates it’s a buyers’ market, but an inventory level below that threshold means we’re in a sellers’ market. Today’s inventory level sits far below the norm.

Why This is Not Like 2008 Again

During the Great Recession, just over a decade ago, the financial systems the world depended on started to collapse. It created a panic that drove some large companies out of business (ex. Lehman Brothers) and many more into bankruptcy.