Home Is Where the Heart Is More than Ever This Year

There’s no denying the financial benefits of homeownership, but what’s often overlooked are the feelings of gratitude, security, pride, and comfort we get from owning a home. This year, those emotions are stronger than ever. We’ve lived through a time that has truly changed our needs and who we are, and as a result, homeownership has a whole new meaning for many of us.

4 Ways Homeowners Can Use Their Equity

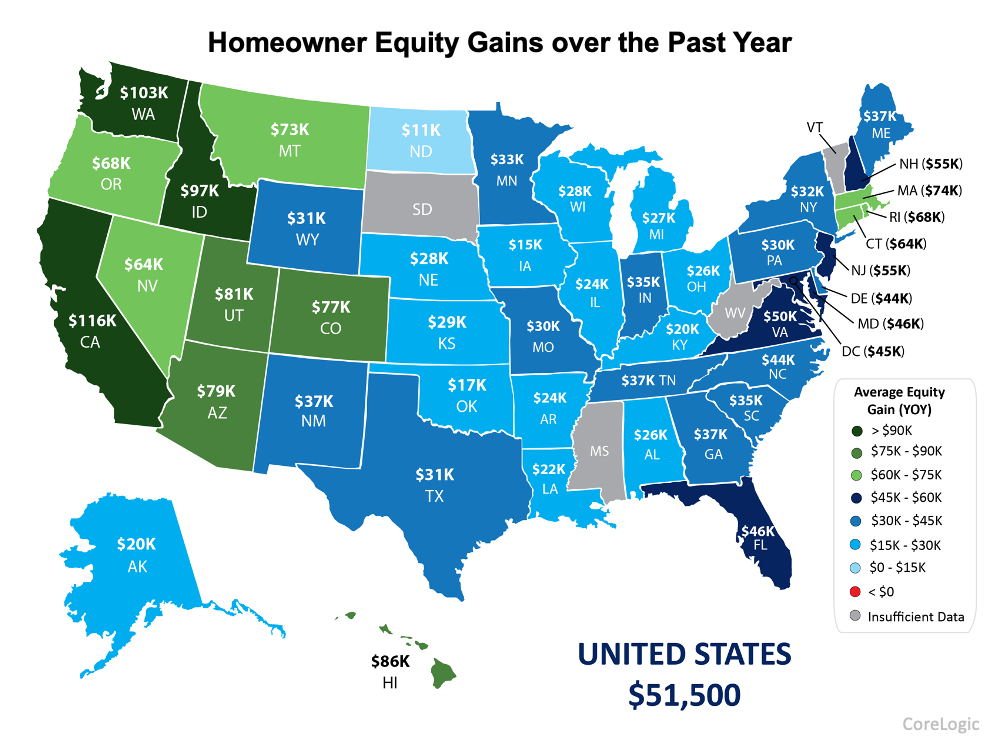

Your equity is a powerful tool that can help you achieve your goals as a homeowner. And chances are, your equity grew substantially over the past year. According to the latest Equity Insights Report from CoreLogic, homeowners gained an average of $51,500 in equity over the past year.

Experts Agree: Homeownership Provides a Path to Long-Term Wealth

A recent survey from LendingTree.com found there are multiple reasons why Americans would choose to purchase a home instead of renting. Some of the most popular non-financial reasons given include: the flexibility to make the space your own, the pride homeownership offers, the sense of stability. In the same survey, 41% of respondents say they’d rather own a home than rent because of the unique way homeownership builds wealth over time.

As Home Equity Rises, So Does Your Wealth

Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In addition to long-term stability, buying a home is one of the best ways to increase your net worth. This boost to your wealth comes in the form of equity.

Is It Time To Move on to a New Home?

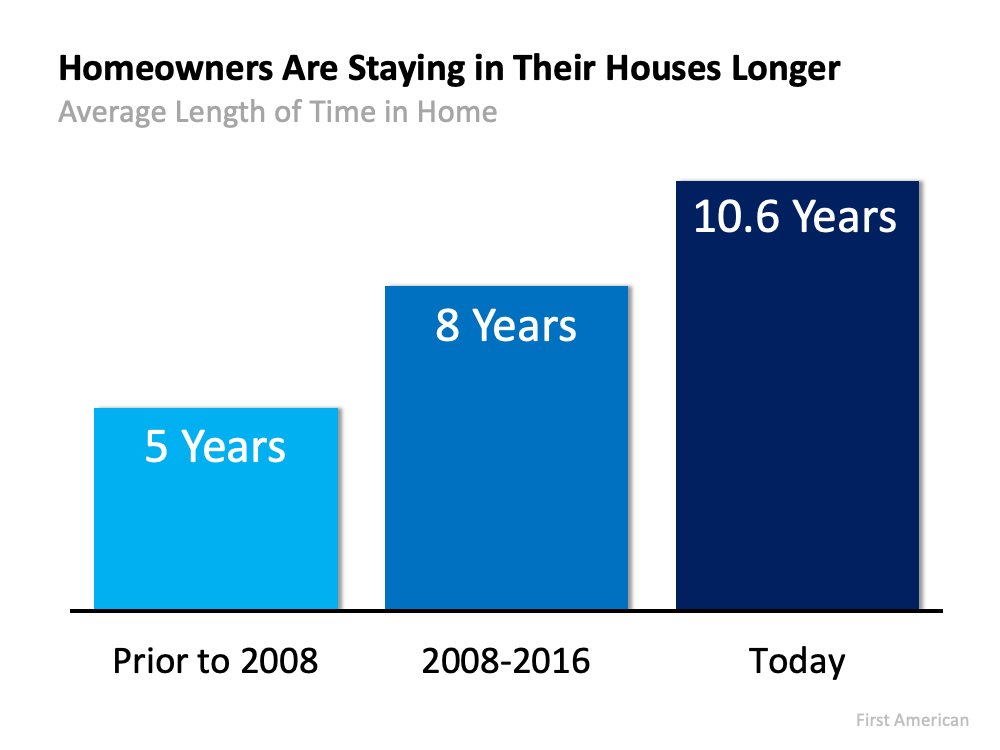

If you’ve been in your home for longer than five years, you’re not alone. According to recent data from First American, homeowners are staying put much longer than historical averages. As the graph shows, before 2008, homeowners sold their houses after an average of just five years. Today, that number has more than doubled to over 10 years. The housing industry refers to this as your tenure.

What You Can Do Right Now To Prepare for Homeownership

As rent prices continue to soar, many renters want to know what they can do to get ready to buy their first home.

The Difference in Net Worth Between Homeowners and Renters is Widening

Becoming financially secure is an important goal for many people today, but some don’t realize just how much homeownership can help them achieve that dream. A recent report, The Journey Toward Financial Freedom, surveys Americans about their perspective on financial wellness and their goals

Homeowner Wealth Increases Through Growing Equity This Year

Building financial wealth and stability remains one of the top reasons Americans choose to own a home, and as a homeowner, your wealth often grows without you even realizing it. In a recent paper published by the Urban Institute, Home Ownership is Affordable Housing, author Mike Loftin illustrates how homeowners increase their equity and their wealth simply by making monthly mortgage payments

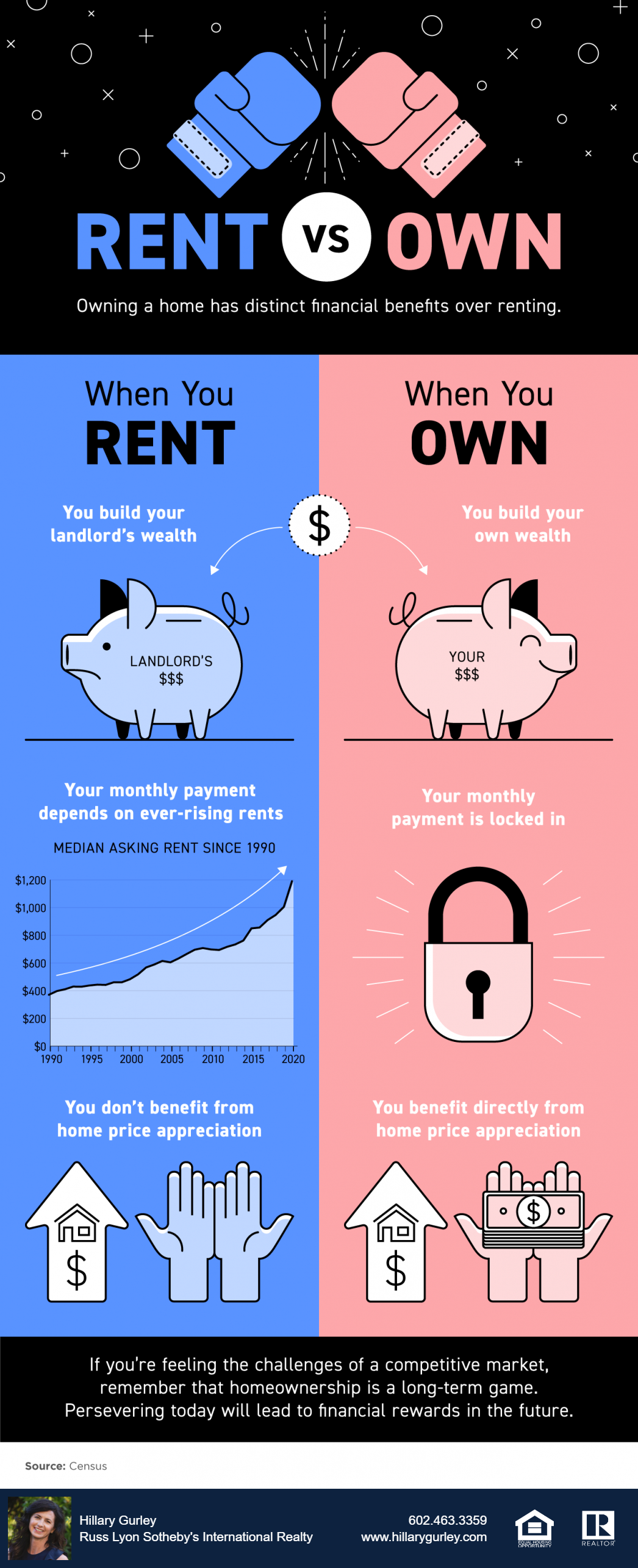

Owning a Home Has Distinct Financial Benefits Over Renting

When you rent, you build your landlord’s wealth, your monthly payment depends on ever-rising rents, and you don’t benefit from home price appreciation. On the other hand, when you own your home, you build your own wealth, your monthly payment is locked in, and you benefit directly from home price appreciation.

Home Price Appreciation is as Simple as Supply and Demand

Home price appreciation continues to accelerate. Today, prices are driven by the simple concept of supply and demand. Pricing of any item is determined by how many items are available compared to how many people want to buy that item. As a result, the strong year-over-year home price appreciation is simple to explain. The demand for housing is up while the supply of homes for sale hovers at historic lows.

Top Reasons to Own Your Home

June is National Homeownership Month, and it’s a great time to consider the benefits of owning your own home. If you’re thinking of buying a home, it might just help you find the stability, community, and comfort you’ve been searching for over the past year.

Misty Copeland’s Five Favorites

After releasing Bunheads, her children’s book, in 2020, Copeland, 38, is now working on two more books, while also partnering with LG Signature (she’s an avid cook) and luxury watch company Breitling to shine a light on global causes and redefine what it means to be a strong woman. Until the new dance and travel season takes off, here are five of Copeland’s favorite home items keeping her cozy and content while staying put.

Americans Find the Nonfinancial Benefits of Homeownership Most Valuable

Homeownership is a foundational part of the American Dream. As we look back on more than a year of sheltering in our homes, having a place of our own is more important than ever. While financial benefits are always a key aspect of homeownership, today, homeowners rank the nonfinancial and personal benefits with even higher value.

93% of Americans Believe a Home is a Better Investment than Stocks

A recent Survey of Consumer Finances study released by the Federal Reserve reveals the net worth of homeowners is forty times greater than that of renters. If you’re wondering if homeownership is a good investment, the study clearly answers that question, and the answer is yes.

Homeownership is Full of Financial Benefits

A Fannie Mae survey recently revealed some of the most highly-rated benefits of homeownership, which continue to be key drivers in today’s power-packed housing market. Here are the top four financial benefits of owning a home according to consumer respondents:

88% – a better chance of saving for retirement

87% – the best investment plan

85% – the chance to be better off financially

85% – the chance to build up wealth

Additional financial advantages of homeownership included in the survey are having the best overall tax situation and being able to live within your budget.

Should We Fear the Surge in Cash-Out Refinances?

It’s true that many Americans liquidated a portion of the equity in their homes last year for various reasons. However, less than half of them tapped their equity compared to 2006, and they cashed-out less than one-third of that available equity. Today’s cash-out refinance situation bears no resemblance to the situation that preceded the housing crash.

Americans See Major Home Equity Gains

Today’s home price appreciation is driving equity higher throughout the country. If your needs are changing and you’re ready for a new home, your equity may be a great asset to power your next move. Now is a great time to put your equity toward a down payment on the home of your dreams.

What is the #1 Financial Benefit of Homeownership?

There are many financial and non-financial benefits of homeownership, and the greatest financial one is wealth creation. Homeownership has always been the first rung on the ladder that leads to forming household wealth.

3 Ways Home Equity Can Have a Major Impact on Your Life

There have been a lot of headlines reporting on how homeowner equity (the difference between the current market value of your home and the amount you owe on your mortgage) has dramatically increased over the past few years. CoreLogic indicated that equity increased for the average homeowner by $17,000 in the last year alone. ATTOM Data Solutions, in their latest U.S. Home Equity Report, revealed that 30.2% of the 59 million mortgaged homes in the United States have at least 50% equity. That doesn’t even include the 38% of homes that are owned free and clear, meaning they don’t have a mortgage at all.

3 Ways You’ll Win When You Buy a Home This Year.

There are so many great reasons to purchase a home, and over the past year, we’ve realized more of them than we ever thought possible. If you’re a first-time homebuyer, having a home of your own can give you a greater sense of security and accomplishment in a time that’s largely uncertain. If you’re a repeat buyer looking for your dream home, making a move might give you the space or features you need to find greater success and happiness in a new normal way of life. Whatever your motivations are, here are three reasons why becoming a homeowner now may help you win big in the long run.