4 Ways Homeowners Can Use Their Equity

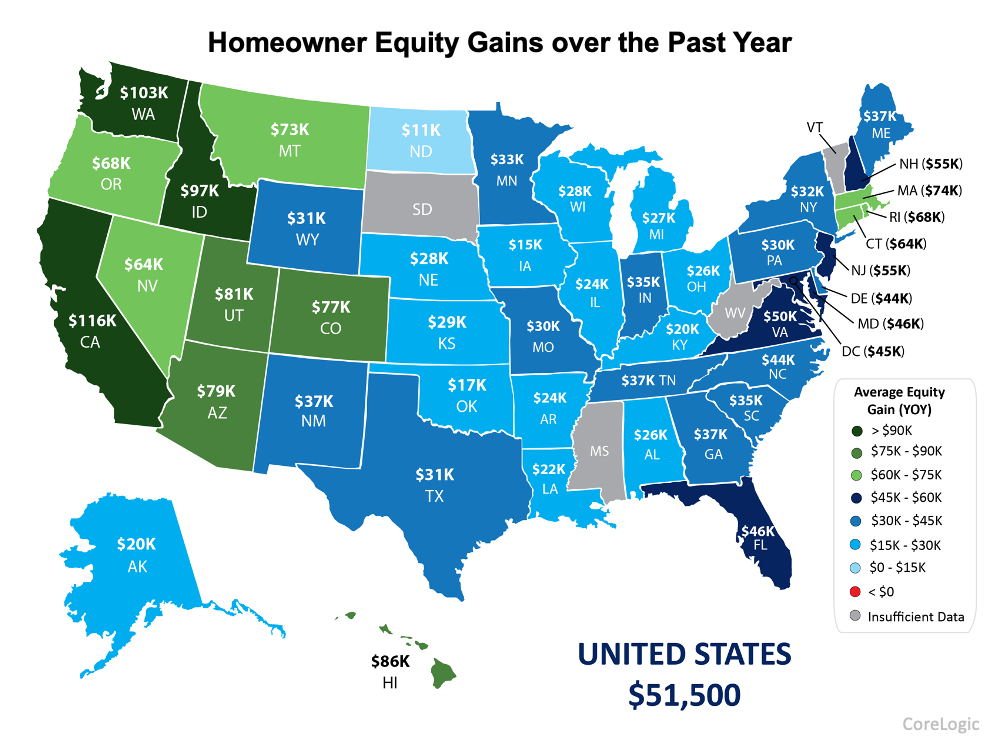

Your equity is a powerful tool that can help you achieve your goals as a homeowner. And chances are, your equity grew substantially over the past year. According to the latest Equity Insights Report from CoreLogic, homeowners gained an average of $51,500 in equity over the past year.

Renters Missed Out on $51,500 This Past Year

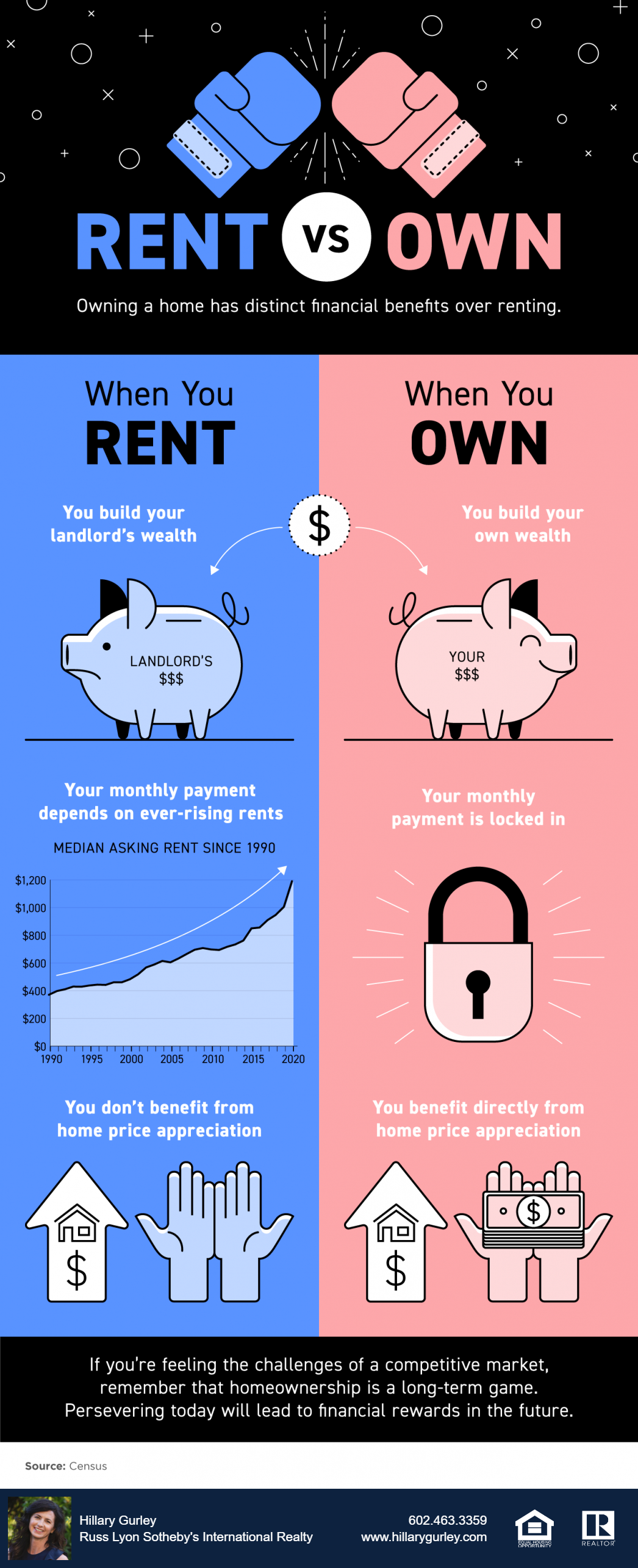

Rents have increased significantly this year. The latest National Rent Report from Apartmentlist.com shows rents are rising at a rate much higher than the three years leading up to the pandemic.

![Your Home Equity Is Growing [INFOGRAPHIC]](https://images.squarespace-cdn.com/content/v1/664518da99a0db1a32b5b0d8/1715804463310-4YBY7RBSGDIBOOAA4092/your-home-equity-is-growing.png)

Your Home Equity Is Growing [INFOGRAPHIC]

If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business, your home equity is a great tool you can use to power your dreams.

Don’t Wait for a Lower Mortgage Rate – It Could Cost You

Mortgage rates today are below what they’ve been in recent decades. So, while you may not be able to lock in the rate your friend got recently, you’re still in a great position to secure a rate well below what your parents and even grandparents got in years past. The key will be acting sooner rather than later.

Experts Agree: Homeownership Provides a Path to Long-Term Wealth

A recent survey from LendingTree.com found there are multiple reasons why Americans would choose to purchase a home instead of renting. Some of the most popular non-financial reasons given include: the flexibility to make the space your own, the pride homeownership offers, the sense of stability. In the same survey, 41% of respondents say they’d rather own a home than rent because of the unique way homeownership builds wealth over time.

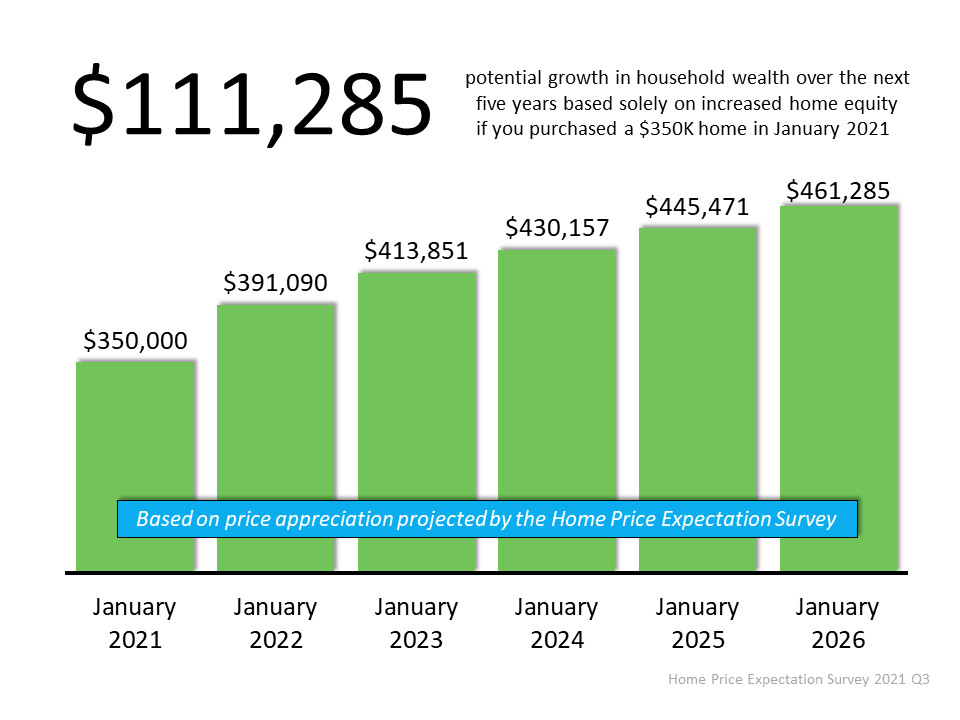

111,285 Reasons You Should Buy a Home This Year

The financial benefits of buying a home versus renting one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as a homeowner. An increase in equity builds the wealth of the individual that owns it. This wealth can be passed down to future generations.

As Home Equity Rises, So Does Your Wealth

Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In addition to long-term stability, buying a home is one of the best ways to increase your net worth. This boost to your wealth comes in the form of equity.

Is a 20% Down Payment Really Necessary To Purchase a Home?

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is the biggest hurdle.

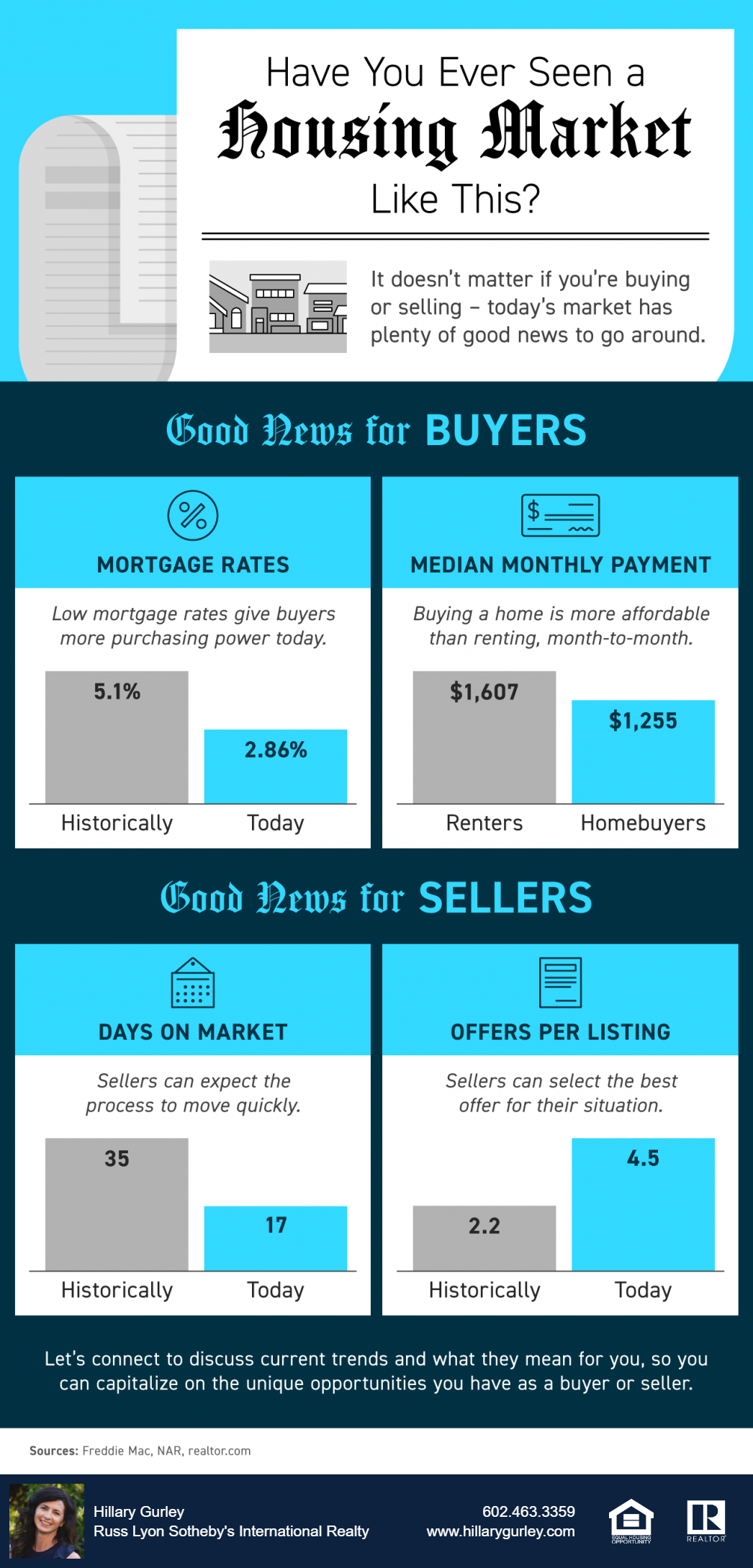

Have You Ever Seen a Housing Market Like This?

Whether you’re buying or selling – today’s housing market has plenty of good news to go around.

What Buyers and Sellers Need to Know About the Appraisal Gap

It’s economy 101 – when supply is low and demand is high, prices naturally rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals.

The Difference in Net Worth Between Homeowners and Renters is Widening

Becoming financially secure is an important goal for many people today, but some don’t realize just how much homeownership can help them achieve that dream. A recent report, The Journey Toward Financial Freedom, surveys Americans about their perspective on financial wellness and their goals

If Housing Affordability is About the Money, Don’t Forget This.

There are many non-financial benefits of buying your own home. However, today’s headlines seem to be focusing primarily on the financial aspects of homeownership – specifically affordability. Many articles are making the claim that it’s not affordable to buy a home in today’s market, but that isn’t the case.

A Look at Housing Supply and What It Means for Sellers

One of the hottest topics of conversation in today’s real estate market is the shortage of available homes. Simply put, there are many more potential buyers than there are homes for sale. As a seller, you’ve likely heard that low supply is good news for you. It means your house will get more attention, and likely, more offers. But as life begins to return to normal, you may be wondering if that’s something that will change.

Today’s Real Estate Market Explained Through 4 Key Trends

As we move into the second half of the year, one thing is clear: the current real estate market is one for the record books. The exact mix of conditions we have today creates opportunities for both buyers and sellers. Here’s a look at four key components that are shaping this unprecedented market.

Your Home Equity Can Take You Places

The amount of wealth Americans have stored in their homes has increased astronomically. On average, homeowners gained $33,400 in equity over the last 12 months, and the average equity on mortgaged homes is now $216,000. When it’s time to sell, your home equity can help accomplish your goals. Let’s connect to discuss how you can take advantage of today’s sellers’ market to get the most out of your home sale.

A Look at Home Price Appreciation Through 2025

Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s equity. And with these recent gains, homeowners are witnessing their financial stability and well-being grow to record levels.

Homeowner Wealth Increases Through Growing Equity This Year

Building financial wealth and stability remains one of the top reasons Americans choose to own a home, and as a homeowner, your wealth often grows without you even realizing it. In a recent paper published by the Urban Institute, Home Ownership is Affordable Housing, author Mike Loftin illustrates how homeowners increase their equity and their wealth simply by making monthly mortgage payments

Owning a Home Has Distinct Financial Benefits Over Renting

When you rent, you build your landlord’s wealth, your monthly payment depends on ever-rising rents, and you don’t benefit from home price appreciation. On the other hand, when you own your home, you build your own wealth, your monthly payment is locked in, and you benefit directly from home price appreciation.

In Today’s Market, Listing Prices Are Like An Auction’s Reserve Price

For generations, the process of buying and selling a home never really changed. A homeowner would try to estimate the market value of their house, then tack on a little extra to give themselves some negotiating room. That figure would become the listing price. Buyers would then try to determine how much less than the full price they could offer and still get the home. As a result, the listing price was generally the ceiling of the negotiation. The actual sales price would almost always be somewhat lower than what was listed. It was unthinkable to pay more than what the seller was asking.

Why You May Want to Cash In On Your Second Home

When stay-at-home mandates were enforced last year, many households realized their homes didn’t really fulfill their new lifestyle needs. An office (in some cases two), a media room, space for children to learn, a gym, and a large yard are all examples of amenities that became highly desirable almost overnight.